Home > Media & Technology > Security and Surveillance > Physical Security > Infrared Camera Market

Infrared Camera Market Size By Product (Fixed, Handheld, Pan-Tilt-Zoom [PTZ]), By Technology (Cooled, Uncooled), By Wavelength (Near Infrared, Short-Wave Infrared [SWIR], Mid-Wave Infrared [MWIR], Long-Wave Infrared [LWIR]), By Application (Automotive, BFSI, Commercial, Government & Defense, Healthcare, Industrial, Residential), Industry Analysis Report, Regional Outlook, Growth Potential, Competitive Market Share & Forecast, 2020 – 2026

- Report ID: GMI397

- Published Date: Jan 2020

- Report Format: PDF

Infrared Camera Market Size

Infrared Camera Market size exceeded USD 6 billion in 2019 and is set to grow at 7% CAGR between 2020 and 2026. The global industry shipments are projected to reach 3.5 million units by 2026 owing to increasing deployment of cameras for all-weather and lighting surveillance purposes in various end-use sectors.

An infrared camera detects infrared energy of any object within a certain Field of View (FOV), improving object detection, identification, and classification. The camera is widely used for military, commercial, and industrial purposes. The growing commercialization and declining sensor & detector prices along with advancements in microbolometer technology are propelling the infrared camera market growth.

According to the Stockholm International Peace Research Institute (SIPRI), in 2018, the U.S., India, France, China, and Saudi Arabia together accounted for 60% of the global military spending. In FY2018, developing countries such as China and India increased their defense budget by 5.0% and 3.1% respectively from FY2017. In December 2019, the Indian government announced its plan to deploy high-security surveillance cameras along its land border with neighboring countries. Infrared cameras will offer improved night-vision and all-weather surveillance to the Border-Security Forces (BSF).

Infrared cameras seamlessly operate in harsh environments such as water vapors, smoke, fog, and haze. This ability provides infrared camera an edge over other surveillance equipment when deployed for several industrial & commercial applications such as glassware manufacturing, in-plastic injector molding, and weld monitoring. Automotive and aerospace industries are rapidly adopting the camera due to its sharp night-vision ability and easy integration into automotive as well as cockpit software. The growing adoption of the equipment in several end-use industries is driving the market revenue.

| Report Attribute | Details |

|---|---|

| Base Year: | 2019 |

| Infrared Camera Market Size in 2019: | USD 6 billion |

| Forecast Period: | 2020 to 2026 |

| Forecast Period 2020 to 2026 CAGR: | 7% |

| 2026 Value Projection: | USD 10 billion |

| Historical Data for: | 2016 to 2019 |

| No. of Pages: | 300 |

| Tables, Charts & Figures: | 500 |

| Segments covered: | Product, Technology, Wavelength and Application |

| Growth Drivers: |

|

| Pitfalls & Challenges: |

|

Infrared Camera Market Analysis

Fixed infrared cameras accounted for over 40% of the U.S. industry share in 2019 and is expected to increase its market size during the next few years. Monitoring & surveillance of airport perimeters is a key challenge for numerous local, state, and federal agencies. Infrared camera industry players are developing the cameras to enhance the signal to noise ratio, offer a higher processing capability & better range, and reduce false alarms.

These are deployed at a specific height and distance to provide 360-degree coverage. Fixed short-range infrared cameras with long-range surveillance capability are used in airport perimeter security to ensure zero gaps in the perimeter coverage. The other market segments by product type include handheld and Pan-Tilt-Zoom (PTZ).

The LWIR camera segment will witness high growth due to its ability to operate efficiently in harsh environments such as smoke or aerosol. These cameras are much efficient in detecting objects, which span a very wide temperature range requiring intra-scene imaging of both hot & cold objects. The cameras are widely adopted for long-range surveillance due to their long-range FOV. Furthermore, LWIR-enabled technology cameras are used for military & firefighting applications.

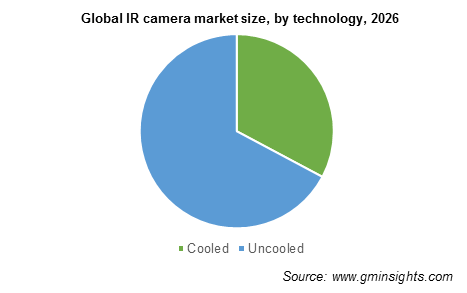

The uncooled infrared camera market will witness steady growth, as the cameras are cheap and require lower maintenance due to absence of cryogenic cooling units. The availability of low-cost uncooled infrared detectors from suppliers and enhanced manufacturability contribute to development of cheap uncooled cameras. Low-cost, easy integration with any security system, and lower maintenance cost are driving the adoption of cameras in surveillance systems in various end-use industries.

In the automotive application, integration of infrared cameras with ADAS will enhance night-vision capabilities and improve passenger safety. Market players are focusing on strategic alliances to integrate the equipment with ADAS. For instance, in October 2019, FLIR Systems, Inc. partnered with Veoneer to integrate the equipment into ADAS of a level-4 AVs for a global automaker. The deployment of these cameras in automobiles will aid in the detection of pedestrians, reducing road accidents and mishaps.

OEMs are rapidly adopting the equipment and integrating them into self-driving software of Autonomous Vehicles (AVs) due to its low-cost, easy integration capabilities, and the ability to offer enhanced all-weather vision (including night-vision). Industry players are developing automotive-specific cameras to increase their market share.

For instance, in May 2019, FLIR Systems, Inc. launched FLIR Automotive Development Kit (ADK) for AVs. The kit is compatible with auto ware, an open-source software for self-driving vehicles. This will help OEMs to train their self-driving software at a comparatively lower cost.

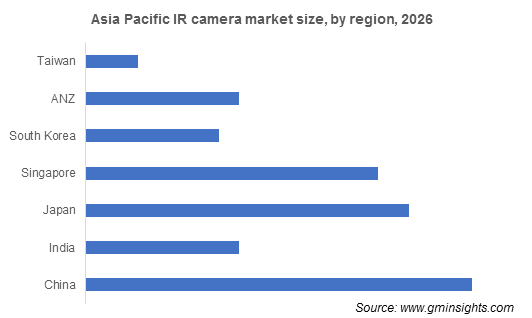

Asia Pacific infrared camera market will expand at around 10.5% CAGR during the forecast timeline due to rise in military spending. According to SIPRI, in 2018, military spending in Asia Pacific was USD 507 billion and accounted for 28% of global military spending. The countries present in the region are spending a substantial amount of their budget on deploying high-security surveillance cameras to track down criminals, improve traffic surveillance, and deploy in big infrastructure projects. For instance, Wuhan Guide Infrared Co., Ltd. provides infrared cameras to the government of China.

The China market is majorly concentrated in Southern China as it helps manufacturers to avail IR LEDs at a cheaper price. Hong Kong, a technology hub, is easily accessible from Southern China, which will benefit manufacturers by reducing their operational expenses. This offers Southern China manufacturers an edge over Eastern and Northern China.

Key market players in the region are focusing on strategic alliances with end-use firms to increase their presence in a specific sector. For instance, in September 2019, Wuhan Guide Infrared Co. Ltd., a manufacturer in China, signed a strategic cooperation agreement with Foresight Autonomous Holdings Ltd. to develop all-weather and lighting condition infrared camera for the automotive sector. This advanced vision technology will also boost the local automotive sector.

Infrared Camera Market Share

The infrared camera industry is a highly competitive market with the presence of a large number of players. The low-entry barriers for new entrants are expected to further increase market competitiveness. Market players are investing in supplier companies to enhance their product ability.

For instance, in December 2019, FLIR Systems, Inc. announced its strategic investments in Providence Photonics, LLC. Providence Photonics develops software, which quantifies invisible gas emissions using FLIR Optical Gas Imaging (OGI) cameras. This investment will help FLIR to enhance its cameras for applications in the oil & gas industry.

Major market leaders operating in the market include:

- Axis Communications AB

- DIAS Infrared GmbH

- FLIR Systems

- Fluke Corporation

- Fujifilm Holdings Corporation

- Xenics Hangzhou Hikvision Digital Technology Co., Ltd

- Hanwha Techwin Co., Ltd. (Hanwha Aerospace Co., Ltd.)

- Honeywell International, Inc

- Infrared Cameras, Inc

- InfraTec GmbH

- Leonardo DRS (Leonardo SPA)

- OMEGA Engineering, Inc. (SPECTRIS PLC)

- OPGAL OPTRONIC INDUSTRIES LTD

- Optris GmbH

- Panasonic Corporation

- Raytheon Company

- Seek Therma

- SiOnyx LLC

- Testo AG.

The infrared camera market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue in USD from 2016 to 2026 for the following segments:

Click here to Buy Section of this Report

Market by Product

- Fixed

- Handheld

- Pan-Tilt-Zoom (PTZ)

Market by Technology

- Cooled

- Uncooled

Market by Wavelength

- Near Infrared (NIR)

- Short-Wave Infrared (SWIR)

- Mid-Wave Infrared (MWIR)

- Long-Wave Infrared (LWIR)

Market by Application

- Automotive

- BFSI

- Commercial

- Government & Defense

- Healthcare

- Industrial

- Residential

- Others

The above information is provided on a regional and country basis for the following:

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Russia

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia & New Zealand

- Taiwan

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- GCC

- South Africa