- Home

- News & Insights

- Vision Technology is ready to take off

Vision Technology is ready to take off

Strong performance and attractive outlook

As in a variety of several other industries, 2020 was a highly challenging year for the machine vision industry as well: not only did Corona have an impact, but the US-China relationship and a looming no-deal Brexit also left their marks. Both in Germany and in Europe, already towards the end of 2019, the machine vision sector experienced some slowdown, with the shrinking of the automotive sector coming on top of the above. For 2020, VDMA Machine Vision expects an overall decrease in turnover by approx. 9,0% in Germany, whereas this subsector seems to be far less affected than the robotics or integrated assembly solutions space within the robotics & automation industry overall.

However, like other sectors being impacted by digitization, industry experts observe the pandemic to be an accelerator for the entire automation industry, the realization of global supply chains being so vulnerable and needing more resilience opens up new perspectives for robotics and automation. Nevertheless, the macroeconomic situation remains uncertain, but supply chains being rethought, critical parts being manufactured more locally and economically realized by a higher degree of automation and catch-up effects from postponed investments should be the fuel for increasing demand post Corona.

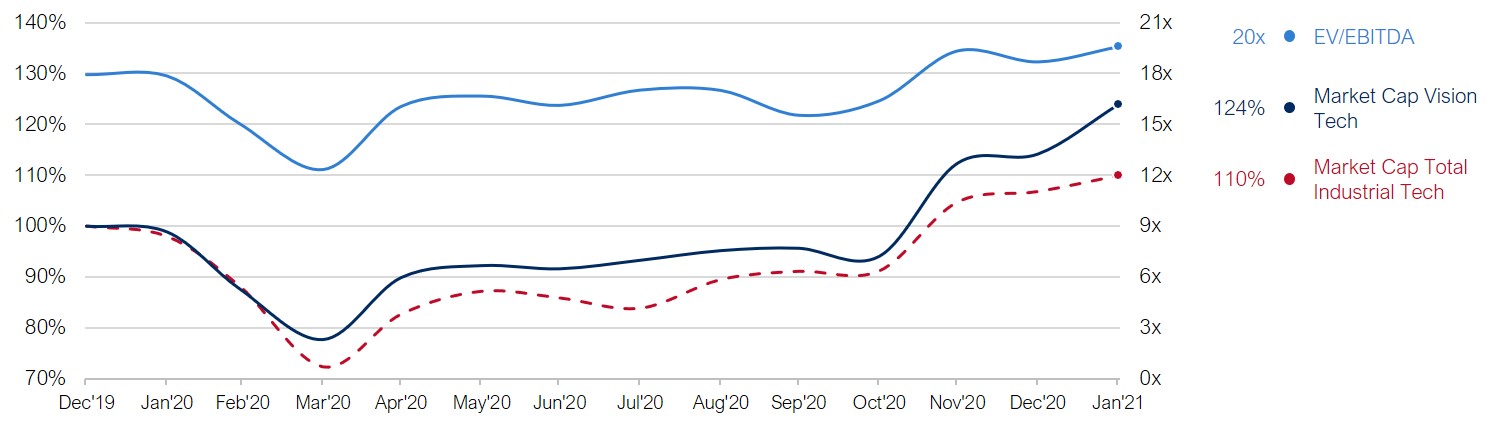

Capitalmind Investec Industrial Tech Indices

Interesting to observe that market capitalization of Vision Technology companies did not suffer as much as the overall Industrial Tech sector index. Although the entire Industrial Tech sector recovered throughout 2020, the Vision Tech sector kept its strength and even outperformed the overall index in the last couple of weeks.

Vision Tech valuations in terms of the mean EV/EBITDA multiples decreased from 18x pre-pandemic to 12x in its first phase in spring 2020. As of beginning of 2021, valuations have recovered and outrun previous year’s levels with a current multiple of 21x.

Vision technology today is an integral part of automation solutions – from inline inspection to machine control, which clearly benefits from abundant computing power enabling extraction or recognition of complex information (a windfall profit from big data, cloud and autonomous driving developments). Digital information, through deep learning, neural networks and sophisticated algorithms enable IIoT architectures.

For sure, the external effects left their marks on the M&A market as well. Compared to 2019, in 2020 the number of deals with German participation didn’t decrease that dramatically, but momentum clearly slowed down in the second half of the year. However, from discussions we have had with business leaders, owners and financial investors we are aware of a remarkably high interest in strategic M&A topics, especially from a buy side perspective. The motivation behind this ranges from acquiring product and system competence to enhance component business and broaden the share of wallet, strengthen the competitive position in core application markets or acquire technology or software know how, e.g. to introduce vision operating systems to the market. These platforms allow to design and operate systems of sensors from various providers and processing algorithms thus allowing for best of breed system architectures.

The following case studies provide for some remarkable examples of how players cope with the challenging market environment in 2020 but nevertheless following a dedicated strategy based on industrial logic and strategic M&A execution.

Case study 1: Atlas Copco AB – ISRA VISION AG – Perceptron Inc.

Sweden-based industrial company Atlas Copco AB is a specialist in four business areas: vacuum, compressor, industrial and power technique. With its 39,000 employees and customers in more than 180 countries worldwide, the group generates about €10,000m in revenues per year.

In 2020, the serial acquirer has successfully extended its offering in the “Industrial Technique” business unit for Machine Vision (MV) solutions. The Industrial Technique division is a supplier of assembly and material removal solutions, quality assurance products, software, and services to customers in a variety of industries. The strategy is to continue to grow the business profitably and to continuously offering products and services that improve its customers‘ productivity, quality, safety and ergonomics. Important activities are to extend the product offering and to provide additional services. By acquiring German MV specialist ISRA VISION AG and subsequently US-based Perceptron, Inc. Atlas Copco has created a new division within the Industrial Technique business unit and has made quite an immediate and substantial step into the MV solutions market. ISRA VISION, one of the global leaders in surface inspection and 3D technology, is complemented by Perceptron’s automated metrology solutions, in combination increasing Atlas Copco’s support to customers on their transition towards digital manufacturing.

Case study 2: Antares Vision S.p.A

Italian company Antares Vision offers comprehensive and scalable global solutions in Inspection Systems, Track & Trace and Smart Data Management. In 2019, 350 employees in 7 branches worldwide achieved € 122 million revenues in more than 60 countries. Its serial acquisition strategy ranges from international expansion to application diversification to venture capital investments:

To strengthen its existing business area in the pharmaceutical sector, Antares Vision acquired Tradeticity, a small Croatian company providing tracking software solutions for the pharmaceutical industry. To expand its software solutions portfolio further, Antares Vision seized the chance to acquire a traceability and serialization software platform from Adents, a French company in liquidation. The transaction will allow Antares Vision to expand its portfolio of software solutions able to track and trace the end-to-end supply chain, enabling all the supply chain players to be compliant to the traceability of medicines regulations.

By taking over Convel, an Italian company specializing in leak testing, a technology aimed at guaranteeing inspection of the highest quality through the detection of any leaks that may affect glass or plastics container sterility, Antares strengthened and diversified its offering in the pharma sector.

With artificial intelligence (AI) getting more and more important for automation applications Antares Vision announced the participation in Boston-based Neurala, a startup in AI applied to visual inspection technologies. The strategy is to boost current data inspection and management solutions through AI with learning models that can add value in foreseeable terms.

US-based Applied Vision has gained a leading position for MV systems for the Food & Beverage industry with high-speed vision inspection systems for glass and metal containers. This acquisition allows Antares to further execute its strategy of expanding its technological leadership to encompass the entire spectrum of inspection process services and at the same time to expand its geographical penetration, especially in the USA. In terms of industry sector expertise, this deal is in line with the acquisition of FT System (Nov ’19).

Many growing application markets like robotics, navigation, logistics, food & agro or surveillance and security cannot go without vision. With further development of e.g. vision guided robots, autonomous cars or edge computing the application scenarios for machine vision products are becoming more extensive, pushing demand for improved manufacturing accuracy, i.e. for innovative machine vision technology. The core technologies are mature, at the same time there is an attractive potential for innovation: keywords like embedded vision, deep learning, blockchain and smart factory point to relevant directions and open up exciting applications. From IIoT to face recognition and body motion interpretation – vision technologies change and sometimes disrupt industry sectors and even daily life. It offers highly attractive growth opportunities across all industry sectors, which is why we see long-term interest in M&A transactions in automation in general and vision technology especially.

Capitalmind Investec has got a senior sector team in Industrial Technology and we are experienced experts in selling, buying and financing businesses.

If you have questions and would like to know more – please get in touch: arne.laarveld@capitalmind.com

![]()